A Strategy That Supports Growth and Success

Our unique investment strategy is built on proven steps and a high-performing platform. The result? Unparalleled growth opportunities.

Our Investment Strategy

Without the right investment strategy, it’s challenging to see any return at all. At Steve Ford International, we put a proven strategy to work on your behalf to improve ROI and ensure you see the value you deserve.

Our Apartment/Multifamily Strategy: How It Works

Any strategy must be based on replicable steps and a deep understanding of the market. Ours is no exception. We acquire apartment buildings in great locations with tons of potential and then improve them by adding value and appeal through luxury renovations, increasing rent, and engaging in expert marketing to attract just the right tenants to boost occupancy. As the property appreciates, we sell or refinance for-profit and provide you with a higher-than-average return.

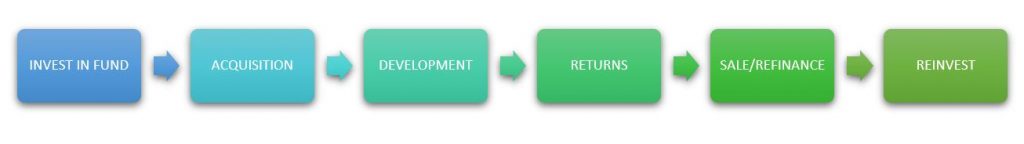

Let’s take a quick look at each step in our investment strategy:

• INVEST – Investors buy into our properties and become part owners of the asset (we serve both accredited and non-accredited investors). • ACQUISITION – We leverage industry contacts and in-depth experience to locate ideal properties and then negotiate the purchase and financing before closing on the property. • DEVELOPMENT – We develop and/or improve the property through interior, exterior, and landscape redesign and development to create luxurious properties that attract the right tenants and increase both cash flow and appreciation. • RETURNS – Our investors receive returns based on their investment through rent collected from each tenant in the property (all tenants are prescreened and creditworthy). • SALE – Eventually, it is time to move on. When the property has achieved sufficient appreciation and stability, we sell or refinance, and each investor receives their investment capital back plus any appreciation/share of the profits. • REINVEST – When we move on to a new investment, you’re welcome to reinvest with us. We strive to create long-term, mutually beneficial relationships with discerning investors like you.

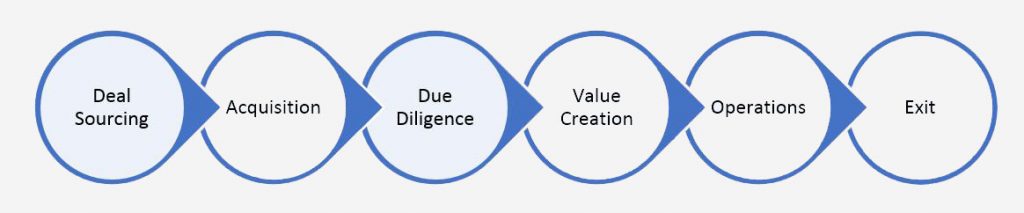

Our Investment Process

You must be able to make an informed decision regarding any investment and working with us is no different. We’ve outlined our investment process below to provide you with all the information necessary to make positive, data-driven decisions to help build your wealth. Deal Sourcing – Our process begins by doing our due diligence and locating high-quality assets in desirable locations. We source with an expert eye for properties that will always generate sufficient cash flow through rent payments, as well as the caliber of tenants the property will attract. We take our role very seriously, and always vet multiple properties before deciding on one. Our selection criteria are stringent and designed to ensure that the assets we choose are well-suited for our investors, as well as the tenants we intend to attract to the property. Before deciding on an asset, we work with both internal and external experts to complete a rigorous analysis of the asset to determine if it is truly right for selection. Acquisition – Once we’ve sourced the deal, it is time to make an offer. Many factors play into the purchase price, and during our asset valuation process, we analyze the deal and look at net operating income generated from the asset, as well as an in-depth market analysis to help us determine replacement costs. We also consider the costs of improvements or renovation required on the asset to protect against overpayment while simultaneously ensuring we can create properties in line with our values and the needs of our investors. Due Diligence – We believe in doing our due diligence at every step of the way. It does not stop after sourcing the right deal, either. Once we choose an asset, we take a deep dive into all aspects of the property, with the goal of gaining a full understanding of its strengths and weaknesses. This helps us make informed decisions in making a go/no-go decision and delivering the best possible returns to our clients. In addition to a strengths and weaknesses assessment, we also consider exit paths and potential future buyers. Finally, we analyze the upside and downside of the property, as well as the valuation of multiples from comparable assets in the surrounding area. If everything meets our discerning requirements, we close on the deal. Value Creation – We have a reputation for setting high standards and creating luxurious living spaces that deliver a high quality of life for tenants and above-average returns for our investors. To maintain that reputation, we make needed improvements to each property in three key areas: renovations, management, and operations. We provide forced appreciation on each asset to increase its value and stabilize the set. Value creation relies on efficiency and expertise, which our team delivers through outstanding tenancy services, industry-leading management, and innovative energy-saving systems. Our value creation strategy will: • Renovate the interior and exterior

• Decrease expenses

• Increase rents

• Replace property management

• Increase the occupancy rate Operations – We pursue two primary goals with every asset: delivering an incomparable living experience to each tenant and offering each investor a better-than-average return. Our operations solutions ensure that we get the best prices and highest-quality services from our vendors to support those goals. We always avoid deferred maintenance and continuously seek ways to effectively reduce expenses and increase income without compromising on quality or aesthetics. Exit – Once the property is fully stabilized and has an occupancy of around 95%, we begin looking to exit. Our exit strategy is well-informed and based on the increase in value and appreciation of the property, which w determine through increased cash flow or net operating income. It is never based on sentiment – only on hard data. If the time is right, we either sell the property or refinance and then pay all our partners and investors.

Financial Strategy

Securing competitive rates and loan terms is central to the success of our efforts. Our debt and interest rate hedging strategy are based on maintaining competitive pricing for the cost of capital by leveraging strong relationships with financial institutions. This allows us to achieve the best possible rates. Those same relationships also help us access debt capital to acquire new deals, as well as for refinancing.

Our Investment Strategies

CriteriaDeal Size - $5 Million - $200 Million Property Type – Mid-Rise and Garden-Style Apartment Communities Year Range – 1980 – 2022 Asset Class – Class A and B Property Size – 100 + Units Location – Atlanta, GA and Southeast Region, USA Market Information – Projected Job Growth, Economic Conditions, Demographics, Job Providers, Location, Rental Potential

CORE PLUS

Core Plus property owners can increase cash flow through light improvements, management improvements, and increasing tenant quality to boost property values. With this strategy, most returns are generated leases and rent payments.Class A Assets

VALUE ADD

Value-add involves buying an under-leased or mispositioned property, improving it in critical ways, and selling it at an opportune time for gain. This strategy essentially relies on appreciation for most of its returns and cash flow.Class B Assets

Our Approach

We strive to exceed expectations not just for our investors, but also for our residents. Each property we purchase and redevelop becomes a distinct destination in its own right – a property that offers the best of modern features and amenities, set in high-demand areas, and able to offer a high quality of life that attracts discerning residents who will not settle for less. To achieve that, we follow a specific vision.

Tenant-Centric Investing Model

We understand that our success (and the success of our investors) hinges on providing an incredible living experience for our tenants. For that reason, we follow a tenant-centric investing model that maximizes quality of life, convenience, and security. From initial deal inception through every step in our process, the tenant’s experience is at the forefront. We ask ourselves, what do great tenants want? What do they expect? What will turn them away immediately? By answering those questions, we ensure that not only do our properties support the highest quality of life and attract the ideal type of tenant but that they generate substantial cash flow and enjoy high occupancy rates. The following are key considerations in the tenant experience:o Sustainability

o Accessibility

o Security

o Wellness

o Food & Beverage

o Entertainment

o Education

o Home Solutions

Amenities

Tenant needs and expectations evolve. We continuously evaluate our tenants’ needs and ensure that their core requirements are met and that our properties live up to their expectations. Some of the most important considerations we make include the following:

• High-quality finishes• A desirable location with good walkability and proximity to dining and shopping

• Energy-efficient building and technology systems, including LED lights, Wi-Fi thermostats, and more

• Well-maintained grounds

• 24-hour maintenance

• Pet-friendly environs

• An online residential portal

• VIP parking

• Electric car charging stations

• The right amenities – a gym, resort-style swimming pool, secured gates, a maintained outdoor recreation area, Amazon Hub package lockers, etc.

• In-unit laundry capabilities

• Monthly events at the property